The heat is on

Apollo Asia Fund: the manager's report for 3Q24

Apollo Asia Fund's NAV per A share rose 6.7% in the third quarter, and 11.0% year-to-date. It's up 35% over the four-plus years since the COVID pandemic began, and 77% since the end of March 2020, when global markets had begun to rally after the initial pandemic slump. Over the 26-plus years since inception, compound annual growth has been 16.5%, and the NAV has multiplied 59-fold.

|

Jul-Sept is the peak of the Pacific typhoon season. This year it brought Typhoon Yagi, but also many storms of unusual ferocity, causing flooding and landslides in many parts of Asia. Malaysia and Singapore are generally out of the path of typhoons, but another impressive downpour is testing my house defences as I write.

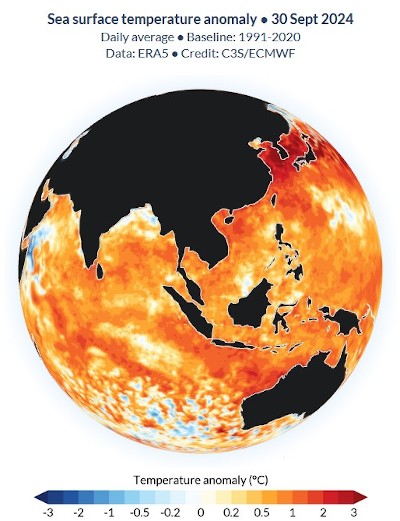

What we now consider extreme may become the new normal. The sea temperature anomaly shown here is not only a danger to coral reefs. Warm air can hold more moisture before releasing it in rainfall, and rising temperatures are expected to cause more heavy downpours almost everywhere; hence the catastrophic floods recently seen on four continents.

As the quarter ended, Hurricane Helene caused significant damage in America, even without a direct hit. The shock of discovering that nowhere is safe may perhaps help to shift policy consensus in favour of more urgent climate action.

Apart from reducing emissions and protecting nature's systems, property owners and governments may need to upgrade ageing infrastructure. They will certainly need to spend on equipment which can withstand higher winds and other extremes, and on maintenance. Tokyo is upgrading its impressive water control tunnel network; many other Asian cities are scrambling to respond to floods and sinkholes as they arise. The costs of maintaining infrastructure are being compounded in some places by theft; the copper telecom cables in my street have had to be replaced twice in the last few months, and arterial power cables likewise.

Policymakers should be rethinking the types of economic activity to be encouraged, the land uses to be allowed, and the sticks and carrots for repositioning. Some of this is visible at city level; much less in national policies. Southeast Asian governments are competing to attract datacentres which are hungry for cheap power, cheap water, and tax incentives. Some demand renewable energy, with occasionally-absurd results: such firms in Malaysia and Singapore are to be key customers for the ecologically-disastrous Pak Beng dam which is expected to worsen the already-disastrous flooding that is impoverishing northern Thailand.

|

The free flow of information is vital to investors, so we read with concern about the trends in Hong Kong leading to self-censorship by academics and by journalists. We read with equal concern of the repression of free speech in the US, UK, and some European countries; for example the UK's detention and harassment of journalists. The double standards are evident, and clearly do not help in the battles for freedom of expression in Asia.

Double standards relating to international law on aggression, invasion, and the treatment of occupied peoples are of particular concern to those worried about the intentions of the PRC, which on 1 Oct celebrated its 75th anniversary. However, the international unease reflected in the huge majority vote against Israel in the UN General Assembly, following the International Court of Justice ruling on the illegality of Israel's presence in the Occupied Palestinian Territories, and the earlier rulings of the ICJ relating to genocide in Gaza, present China with an extraordinary diplomatic opportunity. Forty more countries have now expressed interest in joining BRICS. Why risk direct military action at such a time?

Cyberattacks have been increasing, in Southeast Asia as globally. Anecdotally, outages seem increasingly frequent - bank systems, point-of-sale systems, airline and airport and seaport systems - yet the trend to interconnectivity and the cloud continues, for now. The costs of defence, and to the victims of crime, are evident, but I wonder if adequate attention is being paid to the fragility of systems, and to offline resilience. A year ago the British Library released a two-minute video celebrating its 50th anniversary and explaining how Knowledge Matters, for the economy as well as for scholarship, culture, and national wellbeing; shortly afterwards it was hit by a devastating cyberattack, from which it has yet to recover, and a recent update suggests that some services may never be restored in full. (I hope that the intention is to build something better.)

Given such costs, risks and headwinds, the logic of focussing on resilience and cashflow seems evident. As always, the devil is in the analysis and execution. Suggestions from our investors have always been welcome, and are especially so at present.

We wish all our readers peace, health and safety in the quarter ahead - the conditions in which to prosper.

Claire Barnes, 6 October 2024