To What's new? currently

2 Dec 19:

The NAV of the Series A shares fell 0.4% in November, to US$2,064.16; charts.

17 Nov 19:

Salutes to the HK Forward Alliance, which yesterday

convened a one-day conference to promote dialogue. Limited in physical capacity to 700 participants,

it was rapidly oversubscribed, but the proceedings were webcast so that others could follow

from afar. Professional peacemakers with experience of conflicts around the world joined

concerned Hongkongers to discuss methods of promoting dialogue, reducing polarisation, and

establishing the conditions for substantive discussion of issues and solutions. Professional

conflict negotiators explained the value of broad engagement by ordinary members of society in

finding shared values and common ground, to build on empathy and rebuild trust, in order that

partisans may back away from entrenched positions, rediscover nuance, and allow new perspectives,

to start the examination of underlying issues and opportunities.

They showed how this starts with individuals, and everyday discussions - and the relevance to many

other issues, globally, on which sides have been taken and people are talking past each other.

'WAYS FORWARD: Let's Talk & Listen'

pointed to small contributions we can all make, by learning to engage beyond our circles of

agreement, and cultivating the Art of Conversation.

Resource documents that I found interesting include:

1 Nov 19:

The Apollo Asia Fund NAV rose 1.0% in October, to US$2,072.20; charts.

28 Oct 19:

The 3Q report talks of resilience and a way forward, 'Feeling the stones'.

24 Oct 19:

The Asian Corporate Governance Association, ACGA, has today written to Japan's Ministry of Finance to express

deep concern about proposed restrictions on foreign investment: we share these concerns and agree with the

recommendations.

1 Oct 19:

The Apollo Asia Fund NAV rose 1.3% in September, to US$2,052.30; charts.

3 Sep 19:

The Apollo Asia Fund NAV fell 3.3% in August, to US$2,026.89. Our permanent page on

charts and performance includes some context on

the longer term picture and outlook. The latter is hard to discern, but we keep peering

into the haze. It is haze season in Asia, but nowadays many regions are

getting used to permanent smog, one of many phenomena unimagined at such scale

when the foundations of my original investment approach were laid down.

16 Aug 19:

Mark Mills provided compelling statistics on the environmental

cost of green dreams; Joel Salatin responded with one of the most sensible energy articles

that I have seen for a long time, recommending simpler living, and asking

'What

have you done to reduce energy use?'

9 Aug 19:

|

1 Aug 19:

The Apollo Asia Fund NAV fell 1.4% in July, to US$2,096.73; charts.

The Rukor blog, following a June update on the May series entitled 'Capturing and bridling UNESCO', warns of the unusual challenges for 2020's UN conference for the Convention on Biodiversity, which is to be hosted in Kunming: 'China & global wildlife crisis'.

24 Jul 19:

Apologies, the 2Q report was uploaded without the essential charts. Here it is again, appearing as intended:

'2Q report'.

Singapore on 11 July finally announced long-awaited improvements in its delisting rules to protect minority shareholders, reported in the Straits Times and Business Times.

We belatedly congratulate the independent investors in Challenger Technologies for blocking the squeeze-out delisting, and especially our friends at Pangolin Investment Management which helped with coordination and a series of clearly understandable analytical articles and updates on their website, well worth reading. Following another victory for independent investors at Indofood Agri Resources, a shareholder explains 'Why IndoAgri's recommending directors should resign'. We agree - but independent thinking by "independent directors" and "independent financial advisers" is sadly rare, and not conducive to regulation, so the market-based SGX rule changes are welcome. The Singapore regulators may need to pay close attention to concert parties and claims of independence there, and have signalled that they will do so. Good.

10 Jul 19:

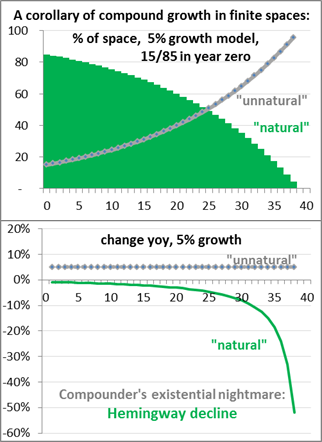

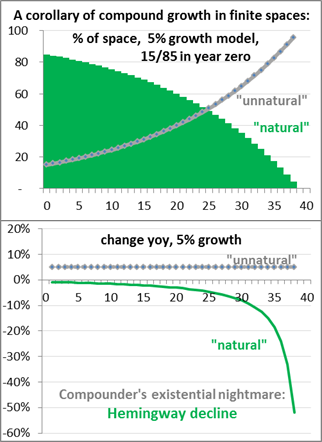

The 2Q report is cheerily entitled 'Compound growth and exponential decline'.

1 Jul 19:

The Apollo Asia Fund NAV fell 0.5% in June, to US$2,126.94; charts.

3 Jun 19:

The Apollo Asia Fund NAV fell 2.6% in May, to US$2,138.33; charts.

The 2018 report of income for UK Reporting Fund purposes is now available here; the page listing all reports (starting 2013) is www.apolloinvestment.com/UKreportingfund.html.

Given our harrowing losses in the squeeze-out delisting of Vard (documented in

'Forced and unfair delistings', April 2018,

and 'Vard saga continues', May-July 2018), I was happy

to read in The Edge that the CEO of Singapore Exchange Regulation is

"pleased with certain 'signature cases' and 'landmark policies'. For example, when Vard's controlling shareholders tried to buy out minorities on what were clearly unfair terms, SGX RegCo responded by revising rules, giving minorities better protection when similar circumstances arise in the future."- so I looked to see details of the rule change. I couldn't find them. A consultation was initiated in November, and closed in December. It's good to hear that there's an intention to protect Singapore's minorities in future - but when?

14 May 19:

Our screens are predominantly red again today - but there is one big macro development that should take your

minds off the intensifying trade war and global politics. It relates to an area of breathtaking natural beauty,

of extraordinary biodiversity, which I was fortunate to visit a long time ago.

It could wreak economic and social as well as environmental havoc

(again).

A terrifying series of reports has been 'written at the urgent request of Chinese environmentalists...

their only way of alerting the world'. It alleges that 'UNESCO staff, acutely aware that China is capturing an

agency of the UN, are shocked but powerless'. The least we can do is to pay attention. Please read:

2 May 19:

The Apollo Asia Fund NAV rose 3.0% in April, to US$2,196.17; charts.

8 Apr 19:

The 1Q report considers prospects for Independent Thinking in the Co-Prosperity Sphere.

1 Apr 19:

The Apollo Asia Fund NAV rose 0.3% in March, to US$2,131.54; charts.

4 Mar 19:

The Apollo Asia Fund NAV rose 1.8% in February, to US$2,125.02; charts.

7 Feb 19:

China's clampdown on imports of waste plastics from January 2018 prompted diversion to other countries,

political outcries, and announcements in several Southeast Asian countries about stemming the flow.

The recent article 'Here’s what happens to our plastic recycling when it goes offshore' suggests that we don't currently

know? as statistics are lagging or lacking? while George Monbiot's appropriately trenchant comments on

'Waste Colonialism' suggest that some

exporting countries may prefer not to collect the info. Unless the countries of greatest consumption back the

innovation-at-the-margin initiatives of companies and the waste-reduction efforts of individuals with coherent policy

and an intelligently balanced regulatory framework of sticks and carrots, the waste may well be channelled to the

countries with the least environmental protections, the remotest corners where supervision is least, or dumped

in the oceans. The former might generate innovation and new winners in which we could consider investment;

the latter may accelerate

environmental apocalypse -

the title of an article full of depressing anecdotes which ends with the very sound recommendation to

enjoy the natural beauty of Asia while we can, and insider tips for ecotourism. If readers can shed light on

effective policy initiatives or positive developments at scale, please let us know.

1 Feb 19:

The Apollo Asia Fund NAV rose 4.0% in January, to US$2,087.29; charts.

Amid the news flood, I draw to the attention of our readers two stories from Australia. Sarawak Report notes a 'Deafening Silence out of Australia over 1MDB's connection to top bank ANZ', which makes one wonder whether the regulator there is worthy of any taxpayer financing. Meanwhile, Australia's most valuable literary award has been won by Behrouz Boochani, still detained in Manus Prison after almost six years, chronicling the country's brutal treatment of refugees, and the extraordinary waste of human talent.

Melvin Gumal proposes Chinese New Year resolutions, explaining why we need to Save The Pigs. The commentator who tries to dismiss him as an armchair conservationist should try to keep up with his field trips in the jungle, and join him in braving the armed poachers. Melvin is one of my heroes, and first came to my attention when he won a Whitley Award.

24 Jan 19:

David Webb explains succinctly

'Why stock-plunges happen so often in HK'. The lack

of interest in protecting investors from unnecessary risks is unhelpful to the social purpose of a stockmarket in

promoting the efficient mobilisation and allocation of capital.

7 Jan 19:

The 4Q report has been posted: 'Flexible investments' - an aspiration, perhaps.

2 Jan 19:

The Apollo Asia Fund NAV fell 3.4% in December, to US$2,006.57; charts.

Claire Barnes

To What was new archive - 2018

To What was new archive - 2017

To What was new archive - 2016

To What was new archive - 2015

To What was new archive - 2014

To What was new archive - 2013

To What was new archive - 2012

To What was new archive - 2011

To What was new archive - 2010

To What was new archive - 2009

To What was new archive - 2008

To What was new archive - 2007

To What was new archive - 2006

To What was new archive - 2005

To What was new archive - 2004

To What was new archive - 2003

To What was new archive - 2002

To What was new archive - 2001

To What was new archive - 2000

To What was new archive - 1999

| Home | Investment philosophy | Fund performance | Reports & articles | *What's new?* |

| Why Apollo? | Who's Claire Barnes? | Fund structure | Poetry & doggerel | Contacts |