Apollo

Investment Management

Cognitive dissonance

Apollo Asia Fund: the manager's report for 3Q2012

The Apollo Asia Fund's NAV rose 11.4% in the third quarter, to a new high of US$1,735.24:

over the last twelve months it was up 40%.

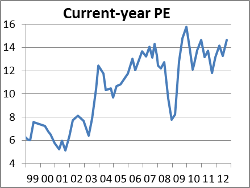

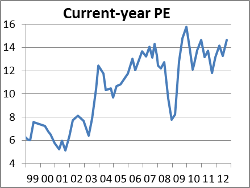

This has taken valuations back to the high end of the historic range.

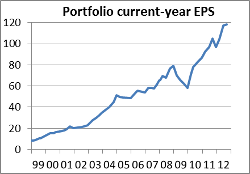

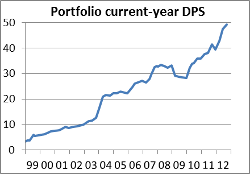

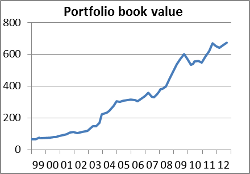

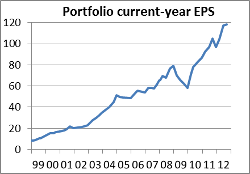

At the end of September, our portfolio was on an estimated current-year PE of 14.7, with

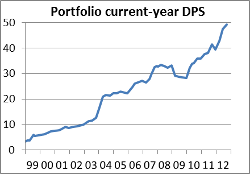

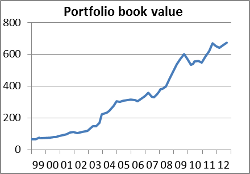

estimated current portfolio EPS up 13% from a year earlier. Over the last five years, compound

growth in the porfolio's earnings, dividends, and assets per share has averaged 9-14% per annum,

depending on the measure. (These figures are derived from the PE, yield, and P/BV of the portfolio,

and may differ from the historic performance of the companies we hold at any given moment.)

If we can maintain fundamental growth at a similar pace in future,

say 10% per annum, we will consider ourselves lucky. Past growth in the Fund's NAV has been

enhanced by rerating; this could be reversed in the future.

Geographical

breakdown

by listing; 28 Sep 12 |

% of

assets |

| Hong Kong |

14 |

| Japan |

15 |

| Malaysia |

11 |

| Singapore |

30 |

| Thailand |

17 |

| Other |

4 |

| Net cash

& receivables |

9 |

| |

100 |

Disappointments in China and India have caused some investors to turn to South East Asia,

where demographic trends are strong and economic management is perceived as more stable.

Our stocks in Malaysia and Thailand have been performing strongly, in some cases reaching

uncomfortably high valuations, and we have been lightening up on some holdings in

both countries. Neither is immune from the problems of the world. Export dependence, check.

Resource limits: check. Rising costs of environmental destruction: check. Misallocation of

capital: check. (In both of the latter categories, there are horror stories to tell -

but perhaps another time.)

In few other areas of the world can the contradictions of our current socio-economic

model be so evident - the environmental strains, and the impossibilities of continuing indefinitely

on the course of the last few decades. In few other areas can planners be so ambitious in their

vision of business-as-usual - or, at least, in their determination to profit as greatly as possible

in the short term. So more concrete will be poured, and GDP will rise - for now.

Perhaps businessmen and officials should pay more attention to the fashion world.

Chanel's new show

features peasant smocks and artists' tunics, hand-made textiles and the romance of the land.

Status symbols are gone. Simplicity is key - and the desire for protection.

Back to the countryside, back to traditional crafts and activities,

and back to the 70's - while expressing hopes for technology in the form of solar panels

and wind turbines. 'Energy

is the most important thing in life', says Karl Lagerfeld.

Claire Barnes, 12 Oct 2012

Previous reports:

- 16 Jul 12 The imprecision

of vital statistics: 2Q12 report for Apollo Asia Fund

- 4 Apr 12 Nifty

valuations: 1Q12 report for Apollo Asia Fund

- 8 Jan 12 The primacy

of resilience: 4Q11 report for Apollo Asia Fund

- 16 Oct 11 Not a normal cycle:

3Q11 report for Apollo Asia Fund

- 26 Jul 11 Open letter

to Securities Commission Malaysia: feedback on Corporate Governance Blueprint

2011

- 22 Jul 11 Bureaucracy and

overcomplexity: 2Q11 report for Apollo Asia Fund

- 8 Apr 11 World in

upheaval: 1Q11 report for Apollo Asia Fund

- 8 Jan 11 Unsustainable

growth: 4Q10 report for Apollo Asia Fund

- 8 Oct 10 More bull:

3Q10 report for Apollo Asia Fund

- 4 Jul 10 Real-world

turbulence, market lull: 2Q10 report for Apollo Asia Fund

- 5 Apr 10 Limits to

growth: 1Q10 report for Apollo Asia Fund

- 23 Mar 10 Energy for Asia:

an overview

- 11 Jan 10 Dangerous times:

4Q09 report for Apollo Asia Fund

- 5 Oct 09 Vertigo again:

3Q09 report for Apollo Asia Fund

- 6 Jul 09 A major bounce:

2Q09 report for Apollo Asia Fund

- 7 Apr 09 Falling prices,

long-term value: 1Q09 report for Apollo Asia Fund

- 6 Jan 09 Tortoise

still crawling: 4Q08 report for Apollo Asia Fund

- 6 Oct 08 Crisis and

opportunity: 3Q08 report for Apollo Asia Fund

- 7 Aug 08 Thai

dividend taxation and NVDRs

- 13 Jul 08 Tectonic shifts:

2Q08 report for Apollo Asia Fund

- 10 Apr 08 The turn of the

stockpicker: 1Q08 report for Apollo Asia Fund

- 11 Jan 08 More interesting

times: 4Q07 report for Apollo Asia Fund

- 8 Oct 07 Complacency

and euphoria: 3Q07 report for Apollo Asia Fund

- 6 Jul 07 The

fully-invested bear: 2Q07 report for Apollo Asia Fund

- 13 Apr 07 The case for

long holidays: 1Q07 report for Apollo Asia Fund

- 6 Jan 07 Thai-phoon

battered: 4Q06 report for Apollo Asia Fund

- 6 Oct 06 Snakes and

ladders: 3Q06 report for Apollo Asia Fund

- 5 Jul 06 To the top

and down: 2Q06 report for Apollo Asia Fund

- 7 Apr 06 Climbing a wall

of irritations: 1Q06 report for Apollo Asia Fund

- 7 Jan 06 Slower growth,

relative value: 4Q05 report for Apollo Asia Fund

- 4 Oct 05 Liquidity

and haze: 3Q05 report for Apollo Asia Fund

- 5 Jul 05 Calm before

the storm?: 2Q05 report for Apollo Asia Fund

- 4 Apr 05 Limitations

in a growing investible universe: 1Q05 report for Apollo Asia Fund

- 7 Jan 05 A time to

recognise good fortune: 4Q04 report for Apollo Asia Fund

- 10 Oct 04 North-east

monsoon approaching: 3Q04 report for Apollo Asia Fund

- 9 Oct 04 Accounting

& disclosure issues in Asia

- 6 Jul 04 Relative

calm: 2Q04 report for Apollo Asia Fund

- 4 Apr 04 Risk

warnings still in force: 1Q04 report for Apollo Asia Fund

- 7 Jan 04 Fun

while it lasts: 4Q03 report for Apollo Asia Fund

- 4 Oct 03 Rise

extended: 3Q03 report for Apollo Asia Fund

- 4 Jul 03 Apollo

in wonderland: 2Q03 report for Apollo Asia Fund

- 6 Apr 03 Turbulent

times, but underlying growth continued: 1Q03 report for Apollo Asia Fund

- 10 Mar 03 Pirates attempt

to seize whole Armada: pitfalls of investing in Malaysia

- 3 Jan 03 A new

high & cautious optimism: 4Q02 report for Apollo Asia Fund

- 17 Oct 02 Relative

resilience: 3Q02 report for Apollo Asia Fund

- 8 Jul 02 A good

harbour: 2Q02 report for Apollo Asia Fund

- 4 Apr 02 Awash

with liquidity: 1Q02 report for Apollo Asia Fund

- 4 Jan 02 Steady

as she goes: 4Q01 report for Apollo Asia Fund

- 10 Oct 01 Resilience

in adversity: 3Q01 report for Apollo Asia Fund

- 5 Jul 01 Prices

more volatile, value still compelling: 2Q01 report for Apollo Asia Fund

- 3 May 01 Opportunities

for selective investors in Asia: article for the Gloom, Boom & Doom

Report

- 13 Apr 01 Earnings

yield 19%; some risk discounted: 1Q01 report for Apollo Asia Fund

- 5 Jan 01 High

seas now evident - how we navigate: 4Q00 report for Apollo Asia Fund

- 10 Oct 00 Tidal waves

forecast, two stocks revisited: 3Q00 report for Apollo Asia Fund

- 6 Jul 00 Price

stagnation, sensational valuation: 2Q00 report for Apollo Asia Fund

- 9 Apr 00 A Pacific

Century - if not for Cyberworks: 1Q00 report for Apollo Asia Fund

- 9 Jan 00 Excellent

values for interesting times: 4Q99 report for Apollo Asia Fund

- 11 Dec 99 Angel of

mercy, or falling angel? Strange happenings at Quality HealthCare

- 14 Nov 99 Apollo Asia

Fund: key terms & summary of features (updated 21 Oct 02)

- 18 Oct 99 Interesting

times ahead! & hence, opportunity: 3Q99 report for the Apollo 001

Fund

- 16 Sep 99 Opacity,

the Asian way? Stock exchange responsibilities on disclosure

- 6 Sep 99 The

all-way case for Asian investment

- 5 Sep 99 Our

type of company - and our type of valuation. A two-stock comparison

- 5 Sep 99 UAF

& Euroclear: lessons and issues

- 4 Sep 99 More

on dollar cost averaging

- 27 Jul 99 After gains,

value persists: 2Q99 report for the Apollo 001 Fund

- 6 May 99 Portfolio

value: an update

- 30 Apr 99 Investment

grade markets, and the imperatives of the herd

- 18 Apr 99 Value, not

momentum: extracts of 1Q99 report for the Apollo 001 Fund

- 3 Mar 99 Perfidious

Thais

- 16 Jan 99 The benefits

of dollar cost averaging

- 16 Jan 99 How good

is the investment case for Asia now?

- 31 Dec 98 Extracts

of manager's 4Q98 report for the Apollo 001 Fund

- 27 Dec 98 Nuggets on

rereading my book, Asia's Investment Prophets